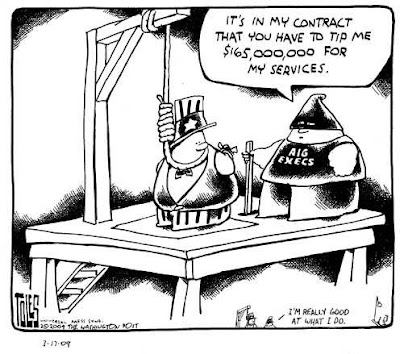

Speaking of being tone-deaf, nobody seems to have a harder time hearing the pulse of America than the executive at AIG. Okay, I get that AIG had legally binding contracts with these executives and that these contracts required them to pay these guys "retention" bonuses. I get the legalities of that . . . although I don't quite get how those retention bonuses can apply to executives who've already left the company.

But here's a question: why don't we ask these executives to waive their rights to these bonuses and not insist on the fulfillment of their contracts. Mayor Menino has asked City of Boston employees to take unpaid days off, and state employees routinely take furloughs in a financial crisis. There are stories in the news about companies whose workers have given up pay so that their colleagues won't be fired. And we can't ask these AIG execs to waive their bonuses voluntarily?

I mean, I'm not surprised that Congress is looking at solutions, like trying to tax these specific bonuses at a 98% tax rate. Cute idea if it works. but I'm not sure that's constitutional . . . and apparently neither is the Congress. Ex post facto problems? Potentially. Wouldn't it just be simpler for the Execs to volunteer to give the bonuses back. That would buy them at least a little bit of good will for the next round of begging with the American people.